In recent years, content marketing has become a widespread strategy being implemented more often and by more industries than ever before. One industry doing it better than many others is the financial sector, namely banks. While banks have actually been using content marketing for decades, their campaigns have really come to the forefront in recent years.

For the financial sector, customer loyalty, retention and brand awareness are imperative; without the trust of customers banks will see low numbers putting their faith in them with their funds and assets. Through clever use of content marketing, banks have regained the trust of their customers. Below we’re taking a look at some great examples of this.

SunTrust Bank

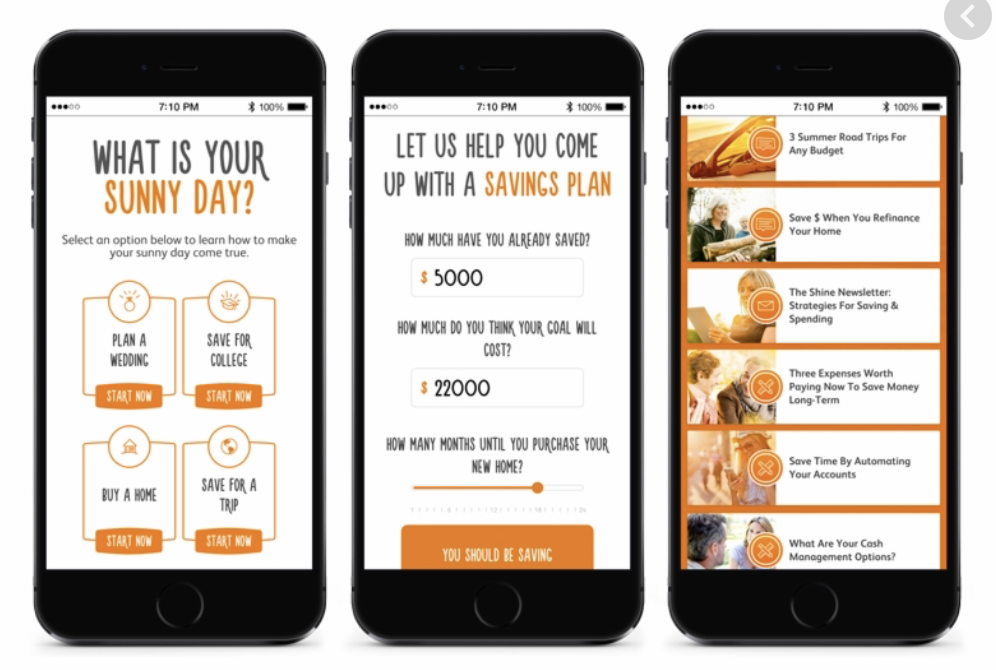

The American bank has a fantastic campaign called ‘Live for a Sunny Day’, in which they encourage customers to not just plan for a rainy day, but also prepare for the ‘sunny’ ones. There is a website to accompany the campaign, where visitors can pick from seven sunny day scenarios such as a wedding day or saving for college.

Each selection leads customers to a custom created page that includes content created specifically for that choice such as quizzes, podcasts, videos, and savings calculators. This fun website shows customers that SunTrust understands the varying needs and wants of their clients. Rather than seeing them as numbers, SunTrust works to appreciate the individual pain points facing their customers and shows how they can positively impact upon these.

Each selection leads customers to a custom created page that includes content created specifically for that choice such as quizzes, podcasts, videos, and savings calculators. This fun website shows customers that SunTrust understands the varying needs and wants of their clients. Rather than seeing them as numbers, SunTrust works to appreciate the individual pain points facing their customers and shows how they can positively impact upon these.

Bank of Ireland

The Irish giant created a campaign called FeelFree last year. It was a sort of student reward campaign, whereby any students who signed up for a new third-level bank account became eligible for €100 worth of rewards in cinema tickets, pizza vouchers and beauty treatments. The rewards were chosen through suggestions from actual students.

The bank also created their own Snapchat account, also with the aim of connecting with younger customers. The Snapchat account does not push advertisements or product endorsement; instead, it contains saving hacks and tips, content that students have told Bank of Ireland they want to see, behind the scenes footage from sponsorships such as sporting events, concerts and fashion shows, and communication with key influencers.

The bank also created their own Snapchat account, also with the aim of connecting with younger customers. The Snapchat account does not push advertisements or product endorsement; instead, it contains saving hacks and tips, content that students have told Bank of Ireland they want to see, behind the scenes footage from sponsorships such as sporting events, concerts and fashion shows, and communication with key influencers.

These simple steps effectively engage young customers and help place Bank of Ireland at the banking forefront for students. A bank that understands the financial struggles and needs of student life, as well as their general interests, becomes a sure choice for young adults.

Barclays and Barclaycard

British bank Barclays created ‘Digital Eagles’ in 2013 to help customers, particularly older customers, to become Internet savvy. The site offers guides such as how to shop online, how to set up an email account, how to use Skype and how to use YouTube. By helping clients get more accustomed to web-use, Barclays proved they understood the needs and pain points of it’s customers, becoming a helpful, trusted aid.

Barclay’s global payment subsidiary, Barclaycard, partnered with popular parenting site Mumsnet to create a series called ‘Shop Talk’ which was geared at mothers who liked to shop; offering online savings advice, shopping tips and fashion trends. Barclaycard also released videos discussing topics such as online shopping, style tips and even etiquette for tipping abroad. Each video ends with a call to action such as downloading the Barclaycard app or signing up for a spend-limit alert.

These strategies helped Barclays and Barclaycard stand firm as an authority on all things shopping and saving, with smart integrated use of product soft sells.

Let us know in the comments section if there are any other campaigns you think should be included on the list! If you would like to talk content marketing and how you can best appeal to your audience, just give us a shout.

All brand images are attributed to Creative Commons Attribution 4.0 International license.